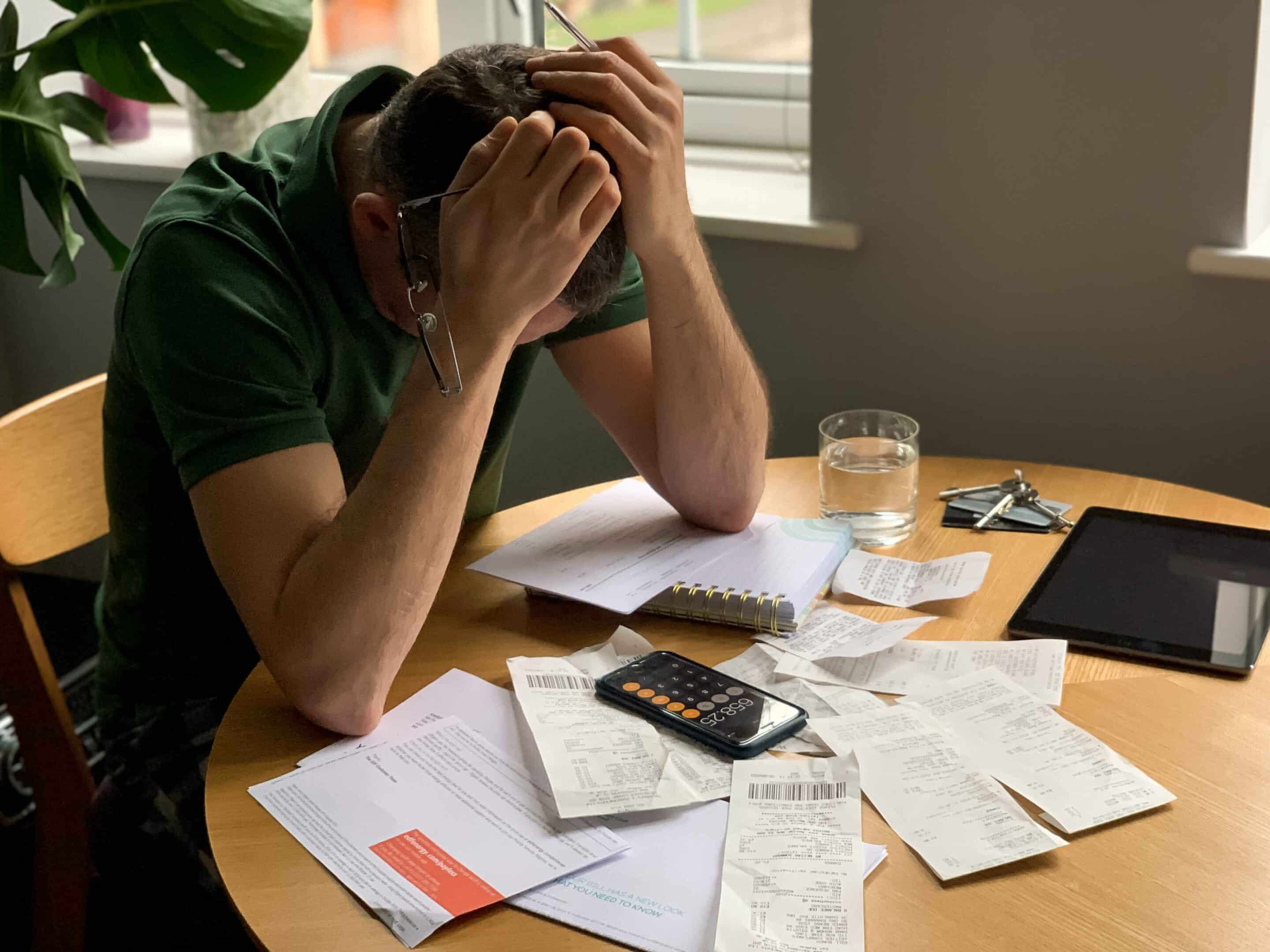

Thailand’s property market is going through a tough time. Slower economic growth, high household debt, and global uncertainties are making it harder for the market to recover quickly. Even though the government and the Bank of Thailand have introduced measures like lower interest rates and relaxed lending rules to help, challenges such as weak demand, rising unsold homes, and cautious spending still remain.

Debt pressures and slow growth test market resilience

Property Market Challenges

Thailand’s property sector is grappling with modest economic growth, high household debt, and global uncertainties that continue to weigh on sentiment. With 2025 GDP growth projected at just 2.3%–2.9%, the Bank of Thailand has moved to support the market by cutting its policy rate to 1.50%—the lowest in two years—and rolling out soft loans alongside reduced interest rates for personal and micro loans.

These measures aim to ease borrowing costs, stimulate demand, and provide relief for low-income households. However, the combination of weak domestic consumption, elevated debt levels, and global trade uncertainty means the recovery will likely be gradual and uneven.

Market Slowdown Ahead

Thailand’s housing market faces strain, with warnings of a potential price war as weak demand pushes developers to compete through price cuts and promotions.

Inventory Levels

Rising

Both low-rise and high-rise projects are seeing growing unsold stock. Developers are relying on marketing campaigns and special deals to reduce supply and drive sales.

Housing Prices

Barely Up

Growth for 2025 is forecast at just 2.3%–2.9%. High debt, weak consumer spending, and trade uncertainty remain major risks for the housing market’s stability.

Lending Rules

Relaxed

The Bank of Thailand raised LTV limits to 100% until mid-2026, while the government cut transfer and mortgage fees to make property purchases easier and boost activity.

Debt Remains a Concern

Household debt is 87.4% of GDP, down over five quarters but still among Asia’s highest. Nearly THB 6 trillion is in housing loans, limiting demand and pressuring borrowers.

Housing Market Faces Uncertain

The housing market in 2025 is set for slow growth of about 2.3%–2.9%, challenged by high debt, weak consumer spending, and ongoing global trade uncertainty.

Key Takeaways for Thailand’s Property Market Players

With the Thai real estate sector facing slower growth, high household debt, and mounting competition, every stakeholder—from developers to policymakers—must adapt to the shifting landscape. Looser lending rules and lower interest rates may create opportunities, but challenges remain.

- Developers: Expect to intensify marketing with “soft discounts,” freebies, and creative packages to move unsold units without heavily cutting base prices.

- Homebuyers: Gain increased purchasing power thanks to relaxed LTV rules and lower borrowing costs, though overall affordability is still a concern.

- Investors & Brokers: Sluggish sales could open attractive entry points, but market risks, including oversupply and economic headwinds, remain significant.

- Policy Analysts: Must closely monitor whether rate cuts and stimulus measures can boost demand without worsening debt burdens.

While Thailand’s housing market offers new opportunities in 2025, success will depend on strategic timing, careful financial planning, and a clear understanding of market risks. Stakeholders who adapt quickly to changing conditions will be best placed to navigate the challenges ahead.

Summary

Thailand’s property market faces a challenging year ahead, with sluggish growth, rising household debt, and a cautious buyer base keeping recovery slow. While relaxed lending rules, lower interest rates, and reduced property fees aim to stimulate demand, developers continue to rely on promotions to move unsold stock. High inventory levels, weak consumer spending, and global uncertainties will test market resilience, making strategic incentives more effective than outright price cuts. Success in 2025 will depend on adaptability—developers, buyers, and investors who respond quickly to shifting conditions will be best positioned to navigate the pressures and seize opportunities.

Sources & References

Interest Rate Cut

to 1.50%

On August 13, 2025, the Bank of Thailand cut its policy rate by 25 basis points to 1.50%—its lowest in over two years. The decision aims to support a slowing economy facing weak demand, high household debt, and trade pressures that risk.

Read more →

Household Debt Declines

Thailand’s household debt fell to 87.4% of GDP in Q1 2025, the lowest since early 2020. The decline was driven by tighter lending standards from banks and targeted government relief measures aimed at easing financial pressure.Read more →

Loan Rules

Eased

In March 2025, the central bank eased lending rules to help the struggling property sector. The change is intended to boost credit access for both homebuyers and developers, supporting sales and helping reduce unsold housing stock. Read more →