Unlocking Profits: A Comprehensive Guide to Cash on Cash Return

“Cash-on-Cash (CoC) Return Tool: Evaluating the Pulse of Your Investments in Thailand. Measure how every invested penny turns into retained cash, a crucial metric for savvy real estate investors. Whether contemplating a new purchase or tracking post-purchase performance, CoC return stands out as a vital calculator, ensuring the health of your investments in the captivating landscape of Thailand.”

Key Insights:

1. Understanding Cash-on-Cash Return

2. How to Compute Cash on Cash Return

3. Significance of Cash on Cash in Real Estate

4. Determining a Favorable Cash on Cash Return

Unravel the potential of cash on cash return! This financial metric gauges short-term investment profitability in real estate. By dividing annual pre-tax cash flow by total cash invested and expressing it as a percentage, it offers valuable insights. Discover its correlation with rental yield and reshape your investment portfolio dynamics. Explore the intricacies to enhance your financial acumen.

Unlock the power of Cash on Cash Return calculation! For real estate investors, assessing investment performance is crucial. Delve into the intricacies of calculating this metric to gain insights into the effectiveness of your investment in relation to the cash invested. Explore the step-by-step guide to elevate your understanding and optimize your investment strategy.

Unlock the nuances of Cash-on-Cash Returns with a focus on crucial variables:

💰 Monthly Rental Income: All revenue, including rent and additional fees.

🏡 Operating Expenses: Fixed monthly costs like maintenance, management fees, and utilities.

🏦 Loan Payments: If you opt for a mortgage.

💸 Down Payment: The initial payment, usually a percentage of the purchase price.

📑 Closing Costs: Expenses during the property purchase, including legal and inspection fees.

🔨 Renovation and Repair Costs: Initial payments to enhance property condition.

📊 Annual Pre-Tax Cash Flow: Total yearly income after operating expenses but before taxes.

🌐 Total Cash Investment: Cumulative sum of down payment, closing costs, and upfront expenses.

⏳ Cash Flow Timeline: Evaluate the consistency and predictability of cash flow for comprehensive returns.

Navigate the waters of financial analysis with these steps:

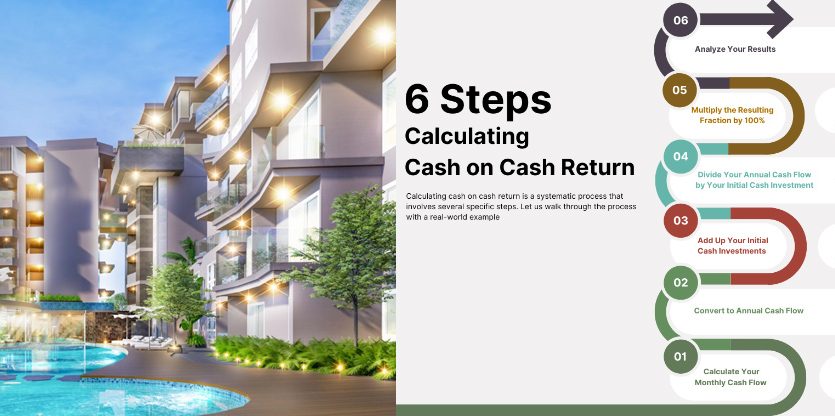

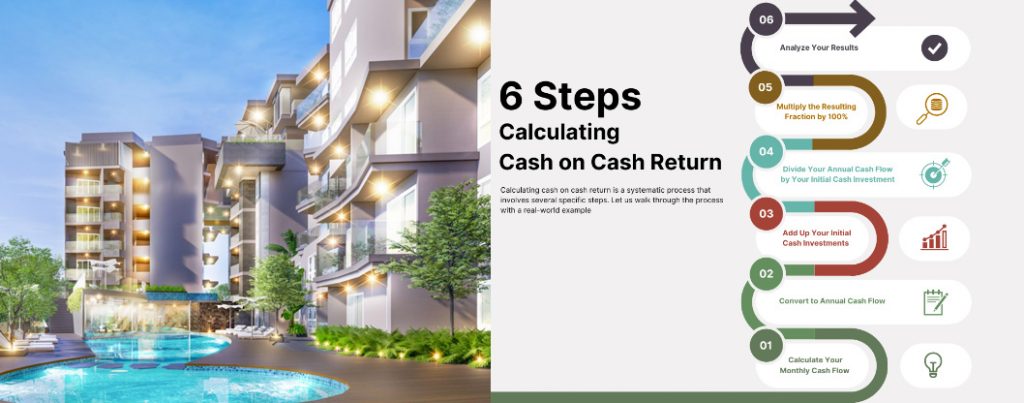

💸 Calculate Your Monthly Cash Flow: Deduct total expenses, including rent and additional fees, from income. For instance, if you earn $2,000 (฿67,580) in rent but have $1,600 (฿54,064) in expenses, your monthly net cash flow is $400 (฿13,516).

🔄 Convert to Annual Cash Flow: Multiply the monthly cash flow by 12. Using the example, your annual cash flow becomes $4,800 (฿162,960) ($400 per month x 12 months).

💰 Add Up Your Initial Cash Investments: Sum all initial cash outlays for the property, including the down payment, closing costs, and repairs. If your property cost $250,000 (฿8,447,500), with a 25% down payment of $62,500 (฿2,115,625), $7,000 (฿236,930) in closing costs, and $3,500 (฿118,465) on repairs, the total initial cash outlay is $73,000 (฿2,471,020).

➗ Divide Your Annual Cash Flow by Your Initial Cash Investment: Divide $4,800 (฿162,960) by $73,000 (฿2,471,020), resulting in approximately 0.0658.

✖️ Multiply the Resulting Fraction by 100%: Convert the decimal into a percentage by multiplying 0.0658 by 100%, yielding a cash on cash return of 6.58%.

🔍 Analyze Your Results: A 6.58% return implies earning slightly over 6 percent of the initial cash investment of $73,000 (฿2,471,020) within a year.

Dive into the realm of real estate investments with the Cash on Cash Formula, particularly crucial for condo owners eyeing profitable returns. In the vibrant context of Thailand’s condo market, this formula acts as a guiding beacon for present and future investment endeavors.

🏠 Quick Mortgage Assessment: Ensure your condo surpasses mortgage costs by utilizing cash-on-cash return. Gauge yearly income against total investment, offering insights into anticipated returns relative to your input.

💡 Smart Investment Choices: Delve into precise investment return details by considering both income and costs. The cash-on-cash formula equips you with valuable information, empowering strategic financial decisions for optimal results.

📈 Planning for the Long Run: Beyond the initial purchase, this formula encompasses all expenses, including maintenance. Tailor your investment strategy to align with goals and risk tolerance, paving the way for sustained and rewarding returns.Embark on a journey of informed and lucrative property investments with the cash-on-cash formula.

What constitutes a good cash-on-cash return is contingent on various factors like interest rates, economic stability, regulatory conditions, and local real estate dynamics, making it a nuanced aspect in real estate investment. The determination of a “good” cash-on-cash return is subjective and aligns with individual investment strategies.

To illustrate, let’s explore calculations for cash-on-cash returns for properties in Thailand:

What constitutes a good cash-on-cash return is contingent on various factors like interest rates, economic stability, regulatory conditions, and local real estate dynamics, making it a nuanced aspect in real estate investment. The determination of a “good” cash-on-cash return is subjective and aligns with individual investment strategies.

To illustrate, let’s explore calculations for cash-on-cash returns for properties in Thailand:

1. Phuket House: Banyan Tree Grand Residence (125M baht)

– Monthly net cash flow: 500,000 baht (after expenses)

– Annual Cash Flow: 500,000 baht * 12 months = 6,000,000 baht

– Cash on Cash Return: (6,000,000 / 125,000,000) * 100% = 4.8%

2. Bangkok Condo: The Lakes (66M baht)

– Monthly net cash flow: 300,000 baht (after expenses)

– Annual Cash Flow: 300,000 baht * 12 months = 3,600,000 baht

– Cash on Cash Return: (3,600,000 / 66,000,000) * 100% = 5.45%

In this comparison, the Bangkok condo offers a slightly higher cash-on-cash return at 5.45% compared to the Phuket House at 4.8%. For those in the exploratory stage, undecided on whether to invest in a house or a condo, recognizing the nuances between these property types becomes paramount. Delving into the distinctive merits and considerations of houses and condos offers valuable insights that resonate with your investment aspirations and lifestyle inclinations. Learn more about the differences between a house and a condo to make an informed decision that best suits your needs.

Utilizing Cash on Cash for the Down Payment Cash-on-cash return serves as a critical instrument in orchestrating the down payment on a property. This metric explains the prompt returns relative to the investment, enabling investors to formulate discerning strategies for impending acquisitions.

How Cash on Cash Helps with Down Payment:

Immediate Insight: This measure provides a snapshot of how quickly the initial investment is being recouped, enabling planning for future down payments.

Sustainable Cash Flow: A favorable Cash on Cash Return signifies a reliable income stream, potentially used for a down payment on a new property.

Strategic Timing: Monitoring cash-on-cash returns aids in aligning down payments with existing investment cash flow and optimizing the investment strategy.

In Summary For those considering real estate investment for rental income, employing the Cash-on-Cash Return formula stands out as the most reliable and pragmatic approach. This method comprehensively factors in nearly all investment variables, including money, installments, down payments, and more. Whether you’re making an investment decision or receiving investment proposals, it’s advisable to utilize this formula to determine the most favorable course of action.